Discover How To Prevent Cavities Naturally

Find Expert Tips For Preventing Cavities by Searching Our Articles!

Popular Articles

We understand the struggle of finding the perfect toothpaste that meets all your needs. That’s why we want to introduce you to a game-changer in oral health – xylitol...

We know how important it is to take care of our oral health. From brushing and flossing to regular dental check-ups, we all strive to maintain a healthy and confident...

We understand how frustrating it can be to deal with the discomfort and damage caused by teeth clenching. Many of us have experienced the same struggle, which is why we...

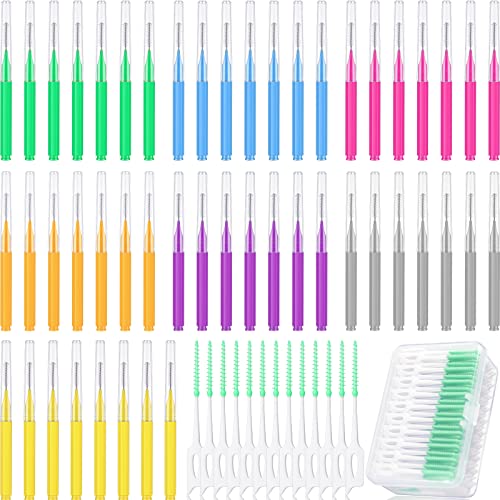

Flossing can be a daunting task for those with braces or dental implants. It’s a delicate balance between maintaining the health of your teeth and braces, or implants...

Finding the right toothbrush can be a challenge, especially when there are so many options available. That’s why we want to talk to you today about soft-bristled...

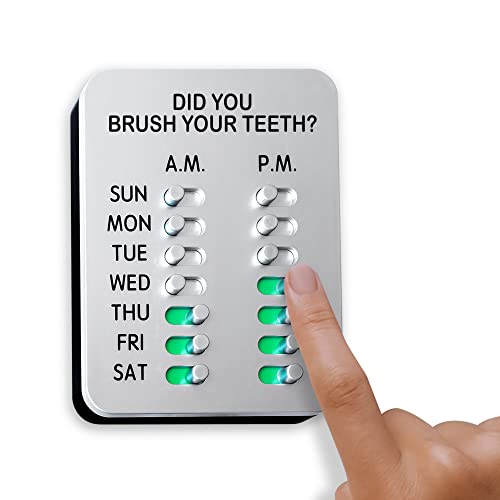

It’s easy to get distracted or lose track of time, leading to a shorter brushing session that may not effectively clean our teeth. That’s why we’re here to help!...

We understand that life can get busy and it's easy to let certain habits slip. But when it comes to taking care of our teeth, consistency is key. That's why we want to...

Are you one of the many people who struggle with sensitive teeth? If so, we understand how frustrating and uncomfortable it can be. Something as simple as enjoying an ice...

In our step-by-step guide on “How to stay motivated in limiting sugary foods and drinks,” we aim to provide practical tips and strategies to help you make healthier...